Sort of disability mortgage. Individual loans, home loans, car loans and other types of loans that disabled people might require all have distinct prerequisites.

You can obtain a bank loan on disability everywhere that offers private loans as lengthy you meet up with the lender’s financial loan skills. Various banks, credit unions together with other lenders offer particular loans.

In the event the interest price is just too higher, your month-to-month payments will likely be also superior. The best financial loan will have decent fascination fees, so that you don’t turn out paying lots on desire service fees.

Pay back greater than the bare minimum: Try to pay a lot more than the least balance required in your debts, although it’s just yet another $ten per 30 days. Just about every excess payment aids in minimizing the overall debt burden. The tips contained on this page are designed for informational needs only.

Jordan Tarver has spent 7 years masking property finance loan, individual loan and company bank loan written content for primary financial publications like Forbes Advisor. He blends understanding from his bachelor's diploma in business enterprise finance, his working experience for a top rated perf...

Except you’re making use of via a Unique mortgage plan, lenders may also choose you on a similar things that they decide everyone else on. This involves components like your:

Economic institutions where you have an check here existing partnership could possibly be far more ready to approve a bank loan.

Repay the financial loan. Based on the lender, you may be able to set up autopay so you don’t pass up any payments. You may additionally qualify for your level discounted by doing so.

You should Really don't interpret the purchase wherein products appear on our Web site as any endorsement or advice from us. Finder compares a variety of goods, vendors and providers but we do not provide information on all available solutions, providers or expert services. Please recognize that there might be other options available to you when compared to the products and solutions, companies or expert services coated by our assistance.

Short-phrase installment loans. If you have quite poor credit score or can’t qualify for a private bank loan thanks to your restricted revenue, you might want to consider a brief-term installment loan. Nonetheless, APRs on these loans can exceed 600%, building them most effective for one-time emergencies only.

Because the passage from the Equivalent Credit history Prospect Act (ECOA) in 1974, lenders can’t discriminate from you for getting a disability. But your credit score rating and profits will however will need to satisfy the lender’s demands:

Unsecured particular personal loan: Since collateral is not expected, your acceptance and borrowing Restrict for an unsecured individual loan is drastically motivated by your credit history rating and financial wellness.

People today with disabilities might call for modifications for their residences or vehicles, or entry to assistive technologies. Specialized loans cater to these needs:

Masking expenditures not protected by insurance plan: You could possibly use a personal mortgage to create a deposit on devices just like a wheelchair lift. A private bank loan also can help cover expenditures like custodial care.

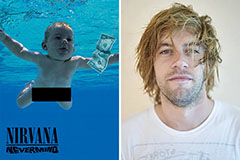

Spencer Elden Then & Now!

Spencer Elden Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now!